If you want to get a bank account in Bolivia, certainly it is possible, but not so easy to achieve. Bank accounts in the country are only permitted for people that have at least a “temporary residence” approved status, so they would be able to get a foreigners’ ID card. This means that if you are coming to the country as a tourist, and only with a transitory residence status approved, you won’t be able to open a bank account here.

To open a bank account in Bolivia, you need at least the status of temporary resident (and not just a tourist). Also, you’ll always need your foreigner ID card issued by the Bolivian government, and usually also your passport, proof of income, an address in the country, and an initial deposit.

We are citizens and business experts from Bolivia, so we’ll give you all the details, requirements, and steps about how to get a bank account in Bolivia as a foreigner. Also, we’ll see some other services that banks in Bolivia normally give to expats and clients from overseas.

Is it possible to open a bank account as a foreigner in Bolivia?

According to Bolivian laws and regulations, you’re allowed to open a bank account in Bolivia, but not as a tourist, only as a temporary or permanent resident in the country, or as a diplomatic dependent.

This is because, to open an account in our country, you need to have an Identification Document (this document is mandatory and can’t be avoided), and to get this document, you need to be at least a temporary or permanent resident of Bolivia (not just a tourist), or be working in a diplomatic institution like an embassy or similar.

This Identification Document can be one of the following:

- A foreigner ID card (provided by the Bolivian government).

- A consular ID card, a diplomatic ID, or a card credential (all of them provided by the Ministry of Foreign Affairs of Bolivia to embassy personnel, diplomats, and other similar dependents in the country).

As a tourist, you can’t open a bank account in Bolivia. You can only if you have a “temporary residence”, or a “permanent residence status” in Bolivia (which by the way are prerequisites to get a foreigner ID). Also, if you are a diplomatic employee, you can easily open a bank account in our country.

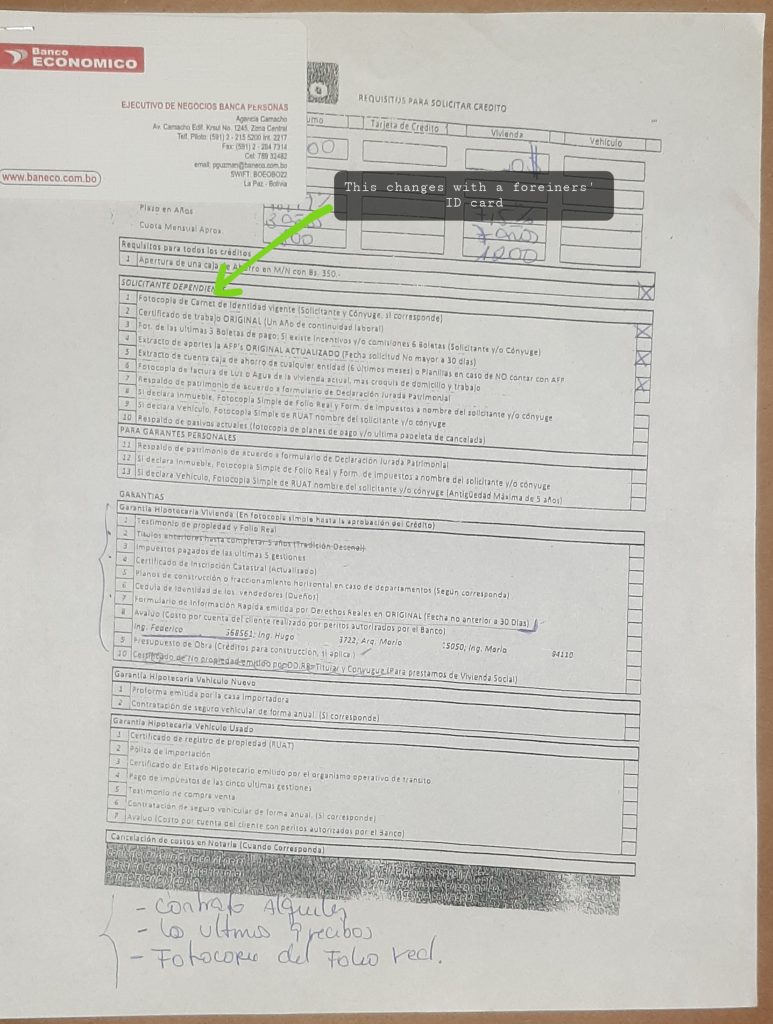

Look for example at the requirements that the BCP Bank has for foreigners to open a bank account in Bolivia:

- Requirements (translated).

If you have your Identification Document and meet the above conditions, then you can open:

- A checking account

- A savings account

- A fixed-term deposit

In some cases, banks will ask you also to meet other requirements, like your valid visa or passport, an initial deposit, proof of your address and/or proof of your income in Bolivia, and similar ones.

Once you have your Foreigner Identification Document, you’ll also need to choose the bank in Bolivia to open this account. Some banks are more willing and capable of attending to clients from overseas (usually the largest ones), while others are not prepared or don’t have enough tools to serve them.

The best banks to open an account in Bolivia

We don’t have all the details about which one is the best bank for you to open a bank account in our country, but we can assure you that most of the largest banks will be capable of opening it for you without too many other requirements or delays.

The banks we recommend for you are:

- The Mercantile Santa Cruz Bank

- The BNB Bank

- The Credit Bank

- The Union Bank

- The Bisa Bank

You can see our dedicated guide about the largest banks in Bolivia (which usually also happen to be the best ones) with all the details and services they offer: The largest banks of Bolivia, a complete overview.

Requirements to open a bank account in Bolivia

Here we’re going to see the detailed requirements to open a bank account in Bolivia when being a foreigner. As you’ll see, the document that will get you in trouble is your Identification Document, the other requirements are very easy to meet.

The requirements and documents to open it an account in Bolivia as a foreigner are:

- Your Identification Document (always):

- Your foreigner’s ID card or

- Your diplomatic ID or

- Your consular ID or

- Another similar document

- Your valid visa or passport (usually)

- Proof of address in Bolivia (usually)

- Proof of income in Bolivia (often)

- An initial deposit (often)

- Other specific documents (rarely)

Your Identification Document (always)

By far this is the most important and mandatory document you need to open a bank account in Bolivia.

Your Identification Document enables you to enjoy all the rights that Bolivians normally have in the country. With this document, you can open a company, get a driver’s license, and also enjoy full Bolivian financial services.

A valid Identification Document, for example, a foreigner ID card, a diplomatic ID, a consular ID, or another similar document, gives you a unique identity within the country.

From the perspective of Bolivian institutions and laws, with this “unique identity”, you can get the rights that both Bolivians and foreigners enjoy when living in the country. This is why it’s so important.

Bolivian Constitution and laws state that:

- Any Bolivian citizen needs a normal ID card to exercise his legal rights and responsibilities.

- Any foreign citizen needs a foreigner ID card to exercise his legal rights and responsibilities.

But this is the issue, as a tourist, with a “transitory residence status” you can’t get a foreigner ID card. Only by being a resident with at least a “temporary residency status” you are able to get this foreigner ID card.

You also can get an alternative Identification Document, only if you are an employee in an embassy or similar diplomatic institution. This document will be a diplomatic ID, a Consular ID, or a Credential, among other similars.

Your foreigner ID card

To get this card, you need to process your temporary residency status in Bolivia and get it approved. The paperwork to do it will cost you around $200. But it is not an easy process, you will need to prove that you want to reside in Bolivia for reasons like a job, health issues, studies, investments, having a company, or similar. You can’t argue that you just want the residence for tourism purposes.

Your diplomatic ID or consular ID or credential

If you work in an embassy or a diplomatic institution like the U.N. the Inter-American Development Bank I.D.B., a nonprofit organization from overseas, or similar, then you can get either a diplomatic ID, a consular ID or a credential, with which you can also exercise all your rights in Bolivia, and of course, get a bank account here.

We have a complete guide about how to obtain a temporary residence status in Bolivia, and also how to get a foreigners ‘ID card, with all the needed requirements and steps: How to be a resident in Bolivia? A detailed guide link.

Your valid visa or passport (usually)

Most of the time, banks will also ask you to provide your valid passport, visa, or similar document. These documents need to be still valid in the future for several months and not expired.

Remember not to confuse bother documents with an Identification Document, they are very different.

Proof of address in Bolivia (usually)

Many times, you’ll also be asked to provide proof of your address or the place where you live in Bolivia. This proof will be in most cases:

- A utility bill’s proof of payment.

- A document that proves you are either the owner or the tenant of the house.

- A rental invoice.

- A property tax proof of payment.

- And similar ones.

Proof of income in Bolivia (often)

Even though these types of accounts aren’t related to any type of loan, very often (some banks won’t ask for this requirement, and with your foreign income will just be fine) you’ll also be asked to provide proof of your income in Bolivia, as banks in the country are more hesitant to trust foreigners.

This proof of income can be:

- A copy of the contract between you and your Bolivian employer.

- An extract of the payments made by your Bolivian employer.

- A balance sheet and income statement of your business in Bolivia.

- Proof that you are the owner of your business in Bolivia or its assets.

- Proof of payments of different taxes related to your business.

- Proof of rental income from your real estate property in Bolivia.

- And similar ones.

An initial deposit (often)

Many banks will also ask you to make an initial deposit in order to open your bank account. This initial deposit can go from $50 to $1,000, but in most cases will be around $100. Don’t worry, after your bank account has been opened, you’ll be able to withdraw all this initial deposit.

Other specific documents (rarely)

In some banks, but it’s rare, you’ll additionally need to provide some of the following documents:

- Residence permit

- A personal reference

- Proof of your ownership of a company in Bolivia

- Other very specific documents

A residence permit is the final document that you get when you obtain the approval of becoming a temporary or permanent resident in Bolivia.

A personal reference may be asked to ensure that you are a trustworthy person and if the bank has some troubles with you as a client, it can appeal to this referenced person in order for him to help the trouble to be fixed.

If you’re getting a bank account through your business or company in Bolivia, proof of your ownership of the company, or that you are a representative of, it will be asked in all these cases.

Steps to open a bank account in Bolivia

- Choosing the best bank for you

- Going to the bank you have chosen

- Presenting all the required documents

- Waiting for the account approval

- Getting your account’s debit card and other stuff

1) Choosing the best bank for you

Although almost all the major banks in Bolivia won’t have any trouble when attending to you as a foreign client, you should also consider the following variables to choose the best bank when opening a bank account in our country.

Number of ATMs and agencies

The 12 major Banks of Bolivia have a wide range of ATMs available across the country, some of them have around 500 of them and others only 100. Anyway, you’ll be able to use the ATM of any other bank by paying a small extra fee of around $0.2/transaction.

The banks that have the highest number of ATMs available in the country are:

- The Mercantile Santa Cruz Bank

- The BNB Bank

- The Union Bank

- The Credit Bank

Minimum initial deposit

As we said before, some banks will also ask you to make an initial deposit to open a bank account. This initial deposit will be from $50 to $1,000, but in most cases, it will be around $100.

You shouldn’t be worried about this initial deposit, as after the bank account is created you’ll be able to fully withdraw it. So in most cases, it’s just a formality and checking seriousness requirement.

Monthly fees

Mostly, bank account fees in Bolivia are $0 to $5 per month, these are mostly due to the bank account maintenance and the debit card insurance fees. Although you are not obligated to get these account insurances, you should add them in most cases. Some banks won’t charge you any extra fee for having a bank account with them.

In regards to replacing your stolen or expired debit or credit card, you’ll get in most cases a charge between $5 to $10 per replacement of the card for another extra one. And these fees will be very similar from bank to bank.

Additionally, unused account fees are almost non-existent in the banks of Bolivia, so you won’t be charged additional fees by not using your bank account.

Interest rate

In Bolivia, the interest rates for different bank accounts have been almost the same since a decade ago. As you can see:

- Interest rates of checking accounts are below 1% in most cases, in almost all the banks.

- Interest rates of savings accounts are around 2.5% for most of the banks in Bolivia, but some of them offer 3.5% and in some cases even 4% per year.

- Regarding fixed-term deposits, many banks offer around 5.5% per year but some will offer you even 6.5%.

Banks in our country will be generally around these numbers. It’s up to you to choose the right one that may give you the best interest rates for your money.

Online banking services

In this area, banks in Bolivia really differ a lot, some of them offer at least decent services, but many of them have low quality in their online services and virtual accounts.

We also have seen that the largest banks also have the best online experience. If you want the best services in 2022, we currently like the online experience that Mercantil Santa Cruz Bank has given to us lately.

Anyway, we recommend you the following three banks for this:

- Mercantil Santa Cruz Bank

- BNB Bank

- Credit Bank

Bank account insurance

All principal banks in the country will offer you bank account insurance, it will have a price between $1 to $5 per month, and it will fully cover your bank account if a money theft happens.

Extra services for foreigners

Once you have your foreigner ID card, you will be treated like a Bolivian by banks, so you will enjoy the same services that Bolivians normally get from banks here.

But to get the best experience, we recommend you go to the largest banks like Mercantile Santa Cruz Bank, BNB Bank, or Credit Bank.

Remember that almost no Bank in Bolivia will be able to handle you in your native language, neither by phone nor by social networks nor physically. Sadly, banks here aren’t used to attending to clients from overseas that speak other languages.

2) Going to the bank you have chosen

After you have chosen the right bank for you in Bolivia, you’ll need to either go physically or virtually to get your account opened.

We recommend you to better go physically, at least the 1st time you open a bank account in our country. Even for us, we have seen that opening a bank account through a virtual way is difficult, and most of the time it doesn’t get done well by Banks. Also, the fact you are from overseas complicates this option more.

We have a dedicated guide to all the banks that exist in Bolivia at this time, with all their contact and location information, and also other details about the quality of their services: Banks of Bolivia: List and a complete overview.

2) Presenting all the required documents

Either physically or visually, you’ll be required to present all your needed documents and proofs that are listed before in this article.

If you present them physically, the bank’s dependent will ask you to provide the original documents, along with photocopies of them.

If you present them virtually, you will be asked for high-quality photos of both your Foreigner’s ID card and other documents.

3) Waiting for the account approval

Once you approach the bank and present all your required documents, your bank account will be opened within minutes, from 10 to 30 minutes in general. In regards to opening a bank account the virtual way, it will be done in a day or two after you submit the form.

5) Getting your account’s debit card and other stuff

After your bank account has been opened, the bank’s employee will give you all opening documents, the contract, and also a debit card linked to the account. You’ll also be given the credentials to access the virtual services for your account.

As you can see, the approval process for your bank account is almost the same as if you were in your own country. Banks in Bolivia are good institutions that most of the time apply the best practices of the industry.

What we really don’t like from banks here is their lack of good online services and online platforms. These are too slow and buggy in most cases, but beyond this, the banks of Bolivia work very similarly to banks in other countries.

Opening a bank account for your Bolivian company

Remember that you can get a bank account in Bolivia through your Bolivian company, being this firm a Unipersonal, S.R.L, or S.A.

To do this you’ll need to provide a personal Identification Document, but also proof of your ownership, partnership, investment, or representative status of this company.

When you have an S.R.L or S.A. company in Bolivia, this is considered a legal person, so it can have under its name a bank account, in any bank of the country. Also, you can open a bank account under your Unipersonal company here in Bolivia, but it will be opened under your name.

To get this bank account, you’ll need to meet many personal and business documents among other requirements, but 1 of the following 2 will be always required:

- Your Identification Document, if your company is Unipersonal.

- The Identification Document of the representative of your company (if he is a foreigner), or his Bolivian ID card (if the representative is Bolivian), for both S.R.L and S.A. companies.

Other services that banks in Bolivia offer to foreigners

The use of ATMs and credit or debit cards

Remember that you can use your foreign Visa or MasterCard-supported credit or debit card at any ATM in Bolivia.

Another story is with American Express, this company is not well supported by ATMs in Bolivia.

Additionally, if you get a debit card from a Bolivian bank, you’ll be able to use it for free in any ATM from the bank itself, and with very little fees in the ATMs of any other Bolivian bank. Fees will generally be around $0.20 per transaction in the ATMs of other Banks.

If you get a credit card in Bolivia (which by the way is possible for you if you have a stable income or job in the country and, of course, your foreigner ID), it will also be supported by Visa or MasterCard and you’ll be able to use it anywhere in the world.

Money and wire transfers

With your bank account in Bolivia, you’ll also be able to do internal bank transfers and wire transfers around the world. Bank transfers within the country will cost you $0 and in regards to wire transfers abroad, it will cost you around 2% of the transfer amount.

Approving loans for you

Also, it’s possible for you as a foreigner to get a loan, either a home loan, business loan, or consumer loan in Bolivia, but to let this happen, you need to:

- Have at least the status of a temporary resident of Bolivia.

- Have obtained your foreigner ID card.

- Prove that you have a stable and long-lasting source of income in the country, maybe a formal job, or being the owner of a company or investment here.

- Very often, the bank will ask you to give a collateral asset that you own as a guarantee. Because you are from another country, the banks will be very careful in giving you a loan, and in most cases, they will ask you for a collateral asset to serve as a guarantee of the loan.

As you can see, certainly getting a loan in Bolivia as a foreigner is possible, but many banks will ask you for a reliable income in Bolivia first and also asset guarantees to guarantee the loan.

Conclusions:

In this guide about how to obtain a bank account in Bolivia as a foreigner, you have seen that it’s very possible to get this account, but you first need to be at least a temporary resident of Bolivia and with a valid foreigner ID card or similar document. The two requirements can’t be avoided in order to open this bank account in the country.

You also saw all the requirements and steps that you’ll need to open this bank account here. You’ll need a temporary residency status and a foreigners’ ID card in all cases, but also usually, your valid visa or passport, proof of your address in Bolivia, and less often, proof of Bolivian income and an initial deposit. Rarely, you will also be asked to provide other specific documents.

Finally, you now know that you can open this bank account mostly physically, but also virtually, and it will take a few minutes on the first way and from 1 to 2 days on the second way. Additionally, you have seen that opening an account in Bolivia has the same process as opening it in other countries, as banks in Bolivia are very similar institutions to banks in other countries.

We hope this information has helped you, and if you want to know everything about all the most important banks of Bolivia, with all their details, contact information, and also the quality of the services, visit our dedicated guide in the following direction: Banks in Bolivia, a full list and all the details.

BolivianExperts.com, information about how to live, work, invest, and travel in Bolivia.