The property tax system in Bolivia is very similar to many other countries, including the US. The principal home taxes are levied on the purchase, ownership, and rental of a house. You may find some issues when paying the property rental tax in the country, but with the other 2, the home sales and ownership taxes, you won’t have any issues.

There are 3 main types of property taxes in Bolivia: 1) The home sale tax, which is paid every time you buy a house, 3% of the sale price; 2) the homeownership tax, paid every year, 0.01% to 0.1% of the house’s market value; and 3) the home rental tax, paid every month, 16% of the rental income.

In this note, we, as Bolivian real estate experts who help lots of Bolivian people in their real estate projects (you can see our Bolivian real estate website), will be talking about all the details of the house taxes that are currently active on our country, and we will go deep on the taxes that will affect you more as a foreigner, together with some other details about how to pay them.

There exist 3 main taxes for homes in Bolivia

Here in Bolivia, you will find 3 different types of property taxes according to the situation, or real estate transaction, in which the house is involved. For example, if you’re buying a house, you’ll pay a house sales tax; if you own a house, you’ll pay a house ownership tax every year; and finally, if you have tenants, you’ll pay a rental tax every month.

The 3 main taxes for homes and real estate in Bolivia are the following:

- The property sales tax

- The property ownership tax

- The property rental tax

| Type of property tax | Tax percentage | Tax paid for a $100,000 house | Where to pay |

| Home sales tax | 3% of the sales price | $3,000 (each time the house is sold) | At the local government |

| Homeownership tax | 0.01% to 0.1% of the home’s value | $50 (each year) | At any Bolivian bank |

| Home rental tax | 16% of the rental income | $80 (each month) | At the taxes Bolivian entity (SIN) |

1) The property sales tax

Every time you buy a house in Bolivia, you must pay a tax that is levied on the purchase of the property. The amount you’re going to pay for this tax is equal to 3% of the property’s purchase price.

For example, if you buy a house in Bolivia with a payment of $100,000 for it, then you’ll need to pay also $3,000 in property sales tax ($100,000*0.03 = $3,000). This amount of money is required to be paid in every house-purchasing process, without any exception, no matter if you are a Bolivian or a foreigner.

This tax is always paid by the buyer of the property, unless it’s a property that is being sold by a company or is a totally brand new property, recently created. In almost all cases, the buyer is who will pay this tax.

2) The property ownership tax (paid annually)

Every person that owns a house or a real estate property in Bolivia needs to pay an annual tax that is levied on the ownership of that property. The amount of this annual property tax is usually equal to 0.01% – 0.1% of the value of the property, but sometimes it can go above or below this range.

As an example, if you own a house in Bolivia that is worth $100,000 in the eyes of the local government (cadastral value), you will need to pay annually between $10 to $100 in property ownership taxes ($100,000 * 0.01%-0.1% = $10-$100). This tax needs to be paid mostly at the beginning of each year, at any Bolivian bank agency available.

The variability of the amount to pay for this homeownership tax is due to the unique way in which each city calculates it, and also because of the features of the property, like its location, constructions, functionality, type of ground, type of neighborhood, etcetera.

3) The property rental tax (paid monthly)

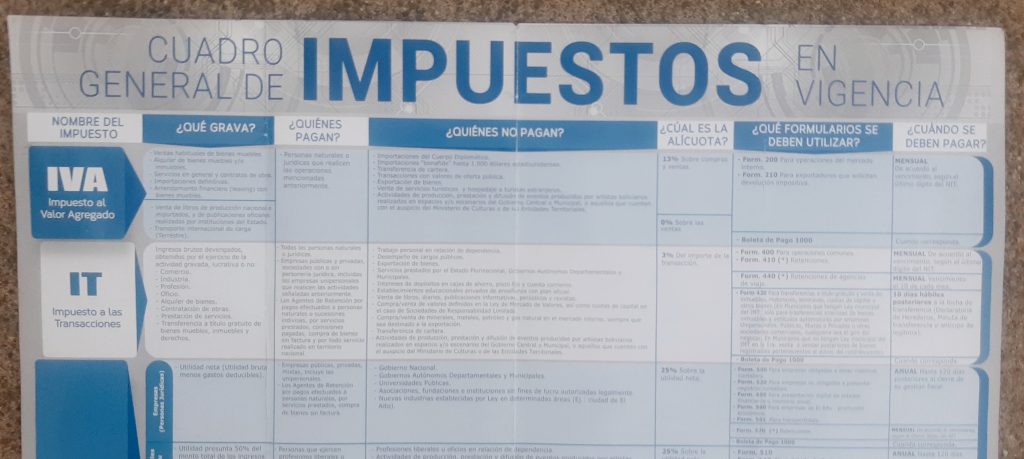

Every time that you, as the landlord, receive a rental income from your tenants, you need to pay a property rental tax in Bolivia, which is levied on the fact that you get an income from this rental, which is also considered a service (VAT or “IVA” in Bolivia). The amount of the rental tax you’ll need to pay is equal to 16% of the monthly rent you receive.

This percentage is composed of 2 sub-taxes:

- The IVA tax, of 13% (which is exactly analogous to the VAT tax in the US).

- The IT tax, of 3% (which is the transactions tax applied in Bolivia).

Then for example, if you get a rental income of $1,000 each month from your home in Bolivia, you’ll need to pay around $160 in property rental taxes ($1,000*0.16% = $160). This tax needs to be paid every month, and sometimes on a quarterly or annual basis. You pay it by filling out an online form and depositing the money at the nearest Bolivian bank available (also virtually).

This tax is a little more complex and involves other various sub-taxes. We have a Spanish in-depth guide about the property rental tax in Bolivia, you can read it in the following direction: Translated: Link. But generally, you’ll need to pay around 16% of your house rental income every month.

Other less common Bolivian house taxes

Of course that there are other property taxes in Bolivia, but they’re far less common and we don’t think you as a foreigner will need to know much about them. For example, the inheritance tax, antichresis tax, agrarian property tax, and property donation tax, among others. These taxes apply more to Bolivians who have an inheritance, rural lands, or other activities, like donations of homes.

Just keep in mind that if you know about and pay the 3 main types of taxes described above, you’ll be just fine with property taxation in Bolivia.

How does the Bolivian property tax system work?

Regulations

The house tax system in Bolivia is regulated by the Bolivian Law No. 843 (see this law translated: Link). This law regulates almost all taxes that are applied in our country, including almost all property taxes.

In this large law, you’ll find all the regulations in regards to how property taxes are calculated, to which situations are levied, which are the exceptions and penalizations when paying these taxes, etcetera. Additional home tax regulations are almost non-existent outside this law, as it has almost all the tax norms currently applied in this country.

Tax payment schedules

Each property tax we described above has a different payment schedule, as we detail in the following lines.

1) The home sale tax

You need to pay this tax during the 10 following days after you signed up for the “Minute of Home Sale Contract” (a more formal home sale contract that will turn into a public deed of home sale).

This tax needs to be paid to the local government of the Bolivian city in which the house is located. Remember that if you pay this tax, but you don’t complete the buying process of the home, it won’t be refunded.

2) The annual ownership property tax

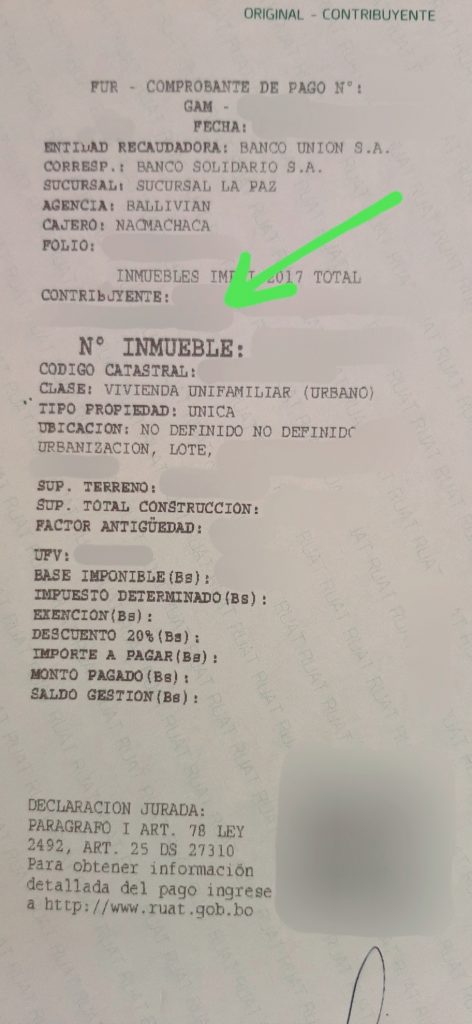

You have almost all the following year to pay this tax, if you pay this tax early, you’ll have several discounts, but if you pay it too late, for example, at the end of the year, you’ll pay it plus a penalty fee. For example, if the property ownership tax corresponds to the 2022 cycle, then you have almost the whole 2023 following year to pay it.

This tax can be paid at any Bolivian bank, and also within your virtual Bolivian bank account, by just presenting your foreigner ID card, issued by the Bolivian government. It can also be paid by your legal representative in Bolivia, who would be allowed to manage your property by a specific power of attorney (be careful with this option! The representative can scam you).

This tax has important discounts, of up to 20% or 30%, if paid early in the year, and penalty fees of about the same percentage, if paid at the end of the year.

3) The monthly property rental tax

This tax needs to be paid on a monthly basis, during the following month after you have received your rental income. In some cases, it also needs to be paid on a quarterly basis or an annual basis, because this tax is formed by several sub-taxes.

To pay the property rental tax, you’ll need to fill out a form from the official public tax entity of Bolivia (SIN), which is available online for registered contributors. After that, and with the number of this filled form, you’ll need to go to a Bolivian bank and pay it. You can also pay it with your Bolivian virtual bank account, or with the help of your legal representative in Bolivia.

Common asked questions about house taxes in Bolivia

Are real estate taxes different for foreigners than for Bolivians?

No in all cases. Bolivian laws apply the same way for Bolivians as for overseas people, this also includes the laws that regulate taxes. So, you have the same rights and obligations as Bolivians when paying property taxes in our country.

The only thing that is going to change is the personal ID document you will present to pay and process these taxes, which will be your foreigner ID document, issued by the Bolivian government. But other than this, you’ll need to follow the same path as Bolivians to pay these taxes, and in many cases, using virtual tools.

This foreigner ID card is only issued to temporary and permanent residents in Bolivia. So as you can imagine, just as a tourist it’s very difficult and risky to buy a house in our country. We talk deeply about this issue in our guide about buying a house here: Can foreigners buy property in Bolivia? All you need to know.

How to know and pay the property taxes you have in debt in Bolivia?

You can know how much you need to pay in relation to house ownership taxes by just following the steps shown in our Spanish guide about this procedure (Translated: Link).

But in summary, to know at least how much you owe in regards to the property ownership tax, follow the next steps:

- You need to have the property tax’s “proof of payment” of your house.

- From this proof of payment, just save the tax number of your house.

- Download the following application:

- After this, with the tax number of your house, follow the instructions in the app and you will know your home ownership tax debt.

- You also can pay this tax without trouble in any bank in Bolivia.

In relation to the property sales tax in Bolivia, it always will be 3% of the house sale’s agreed price. You’ll need to pay it to the local government of the city in which the home is located.

Finally, in regard to the property rental tax, it’s a more complex tax to know and pay. You first need to have a SIN account (this is a virtual platform of the official tax entity in Bolivia), with which you will be able to know how much you exactly owe in rental taxes. To get this account, you need to do some paperwork in the SIN institution. Get it just by physically going to this entity (no virtual way), or through your Bolivian legal representative.

How to save money when paying property taxes in Bolivia?

If you’re paying the property ownership tax, do it at the very early of the year, so you will get a discount from 20% to 30% of the tax amount.

The other 2 taxes, the property sale tax, and the property rental tax, don’t have any kind of discount, and you will need to pay the full official tax amount.

Don’t try to avoid any of these taxes, as they can prove your ownership of the house in Bolivia in future possible legal conflicts and lawsuits, and this proof can save you from losing your house, and also because it’s a legal obligation.

Conclusions:

In this guide about property taxes in Bolivia, you’ve learned that there are 3 main types of taxes that will affect you the most as a foreign owner of a house in the country: 1) the property sales tax, 2) the property ownership tax, and 3) the property rental tax.

You know now that house sales tax consists of 3% of the total sale price and needs to be paid by the buyer of the house. The house ownership tax consists of 0.01%-0.1% of the house’s market value and needs to be paid every year. Finally, the house rental tax consists of around 16% of the rental income and needs to be paid every month.

Also, you’ve learned that these taxes are, most of the time, very easy to pay, with the exception of the property rental tax. The payment process is the same for Bolivians as for foreigners, with the exception that you’ll need to present your foreigners’ ID card. Additionally, you’ve realized that there are discounts of up to 30% if you pay the property ownership tax early, but also penalty fees if you pay it too late.

Finally, now you know that to pay these 3 home taxes, most of the time you can use both physical and virtual ways, and pay them in any Bolivian bank available, in the local government of the city, or in the official taxes government entity, SIN, depending on the tax you are going to pay.

We hope that this information has helped you and if you want to know everything about all the taxes applied and enforced in Bolivia, with all the details about each of them, visit our dedicated guide on the topic: Every tax applied in Bolivia, all the details to know. Link

BolivianExperts.com, information about how to live, work, invest, and travel in Bolivia.