Last Updated on February 14, 2025

Bolivia’s property tax system is quite similar to those in many other countries, including the US. The primary property taxes are levied on the purchase, ownership, and rental of a house. You might encounter some complexities when paying the property rental tax, but the home sales and ownership taxes are generally straightforward.

There are three main types of property taxes in Bolivia: 1) The home sale tax, paid each time a house is purchased, is 3% of the sale price; 2) the annual homeownership tax, ranging from 0.01% to 0.1% of the house’s market value; and 3) the monthly home rental tax, which is 16% of the rental income.

In this article, we, as Bolivian real estate experts who assist many Bolivians with their real estate projects (you can visit our Bolivian real estate website), will explain all the details of the currently active property taxes in our country. We’ll delve into the taxes that will most significantly impact you as a foreigner, along with instructions on how to pay them.

The Three Main Property Taxes in Bolivia

In Bolivia, you’ll encounter three distinct types of property taxes, depending on the situation or real estate transaction involving the house. For example, when buying a house, you’ll pay a property sales tax; if you own a house, you’ll pay an annual property ownership tax; and if you have tenants, you’ll pay a monthly rental tax.

The three main property taxes in Bolivia are:

- Property sales tax

- Property ownership tax

- Property rental tax

| Type of Property Tax | Tax Rate | Tax Paid for a $100,000 House | Where to Pay |

| Home Sales Tax | 3% of the sales price | $3,000 (each time the house is sold) | Local government |

| Homeownership Tax | 0.01% to 0.1% of the home’s value | $50 (annually) – *Example* | Any Bolivian bank |

| Home Rental Tax | 16% of the rental income | $80 (monthly) – *Example* | Bolivian Tax Authority (SIN) |

1) Property Sales Tax

Every time you purchase a house in Bolivia, you’re required to pay a tax *levied on the property purchase*. The amount of this tax is equal to 3% of the property’s purchase price.

For example, if you buy a house in Bolivia for $100,000, you’ll also need to pay $3,000 in property sales tax ($100,000 * 0.03 = $3,000). This tax is mandatory for every property purchase, *without exception*, regardless of whether you’re a Bolivian citizen or a foreigner.

This tax *is always paid by the buyer*, unless the property is being sold by a company or is a completely new property, recently constructed. In nearly all cases, the buyer is responsible for this tax.

2) Property Ownership Tax (Paid Annually)

Every individual who owns a house or real estate property in Bolivia must pay an annual tax *levied on property ownership*. The amount of this annual property tax is typically between 0.01% and 0.1% of the property’s value, although it can occasionally fall outside this range.

For instance, if you own a house in Bolivia valued at $100,000 by the local government (cadastral value), you’ll pay between $10 and $100 annually in property ownership taxes ($100,000 * 0.01%-0.1% = $10-$100). This tax is usually due at the beginning of each year and can be paid at any Bolivian bank branch.

The variation in the amount of this homeownership tax is due to the specific calculation methods used by each city, as well as the property’s characteristics, such as location, construction, functionality, land type, and neighborhood type.

3) Property Rental Tax (Paid Monthly)

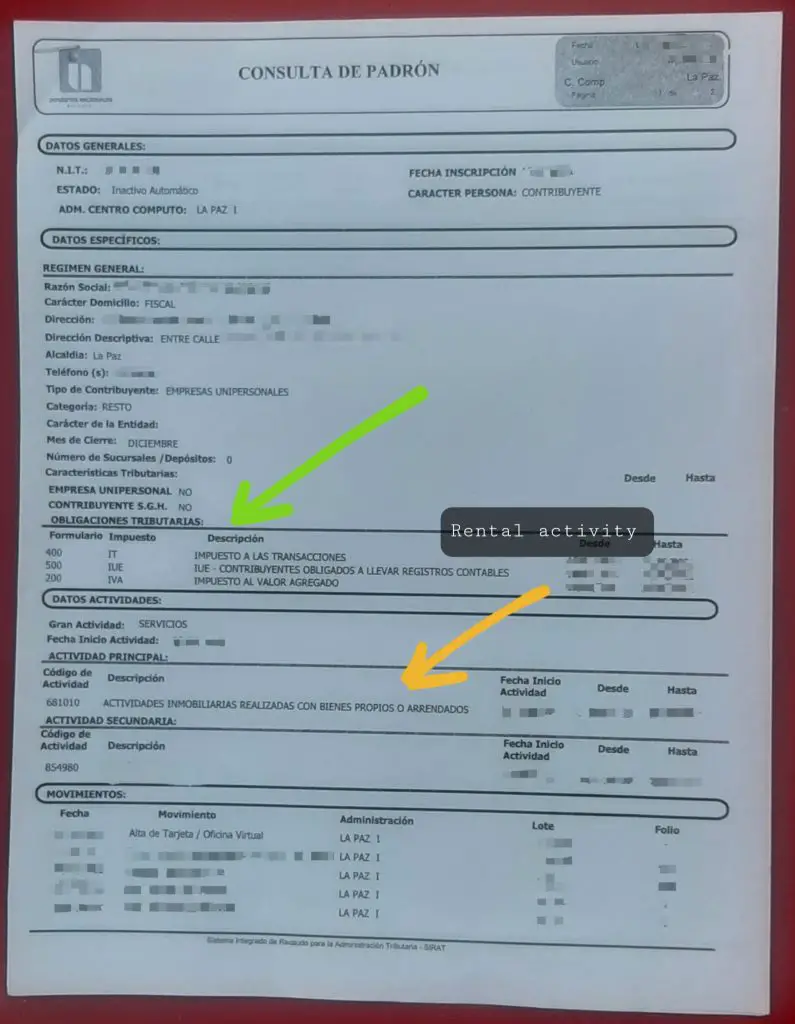

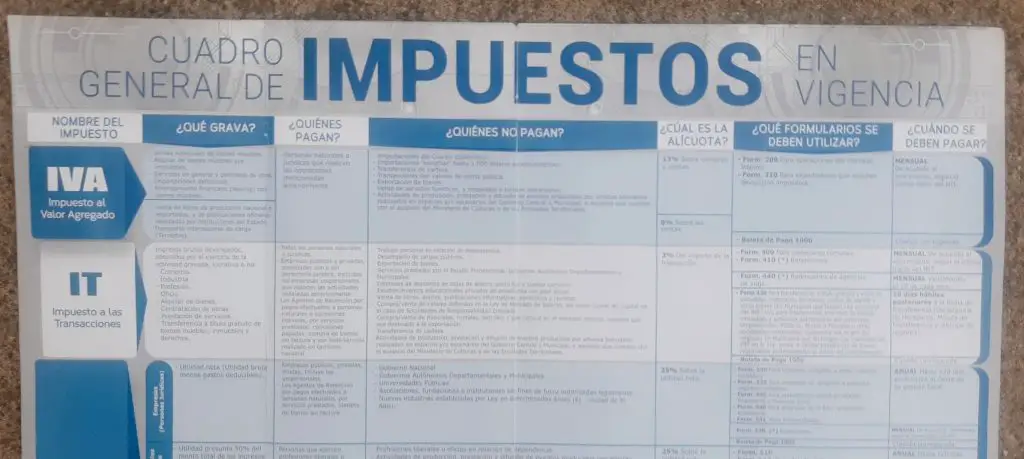

Whenever you, as a landlord, receive rental income from your tenants, you must pay a property rental tax in Bolivia. *This tax is levied because you’re earning income from the rental, which is also considered a service (subject to VAT or “IVA” in Bolivia)*. The rental tax amount is equal to 16% of the monthly rent you receive.

This 16% is comprised of two sub-taxes:

- The IVA tax, which is 13% (equivalent to the VAT tax in many countries).

- The IT tax, which is 3% (a transactions tax applied in Bolivia).

For example, if you receive $1,000 in monthly rental income from your Bolivian property, you’ll need to pay approximately $160 in property rental taxes ($1,000 * 0.16 = $160). This tax is typically paid monthly, though sometimes it’s paid quarterly or annually. Payment is made by completing an online form and depositing the funds at the nearest Bolivian bank (or through online banking).

This tax is slightly more complex and involves several other sub-taxes. We have an in-depth guide in Spanish about the property rental tax in Bolivia, which you can access here: Translated: Link. In general, you’ll need to pay around 16% of your rental income each month.

Other Less Common Bolivian Property Taxes

Of course, there are other property taxes in Bolivia, but they’re far less common, and we don’t believe you, as a foreigner, need to be overly concerned with them. Examples include inheritance tax, antichresis tax, agrarian property tax, and property donation tax. These taxes primarily apply to Bolivians inheriting property, engaging in specific rural land transactions, or making property donations.

Simply being aware of and paying the three main tax types described above will generally suffice for property taxation in Bolivia.

How Does the Bolivian Property Tax System Work?

Regulations

Bolivia’s property tax system is governed by Bolivian Law No. 843 (see this law translated: Link). This law regulates nearly all taxes applied in our country, including most property taxes.

This comprehensive law contains all the regulations regarding how property taxes are calculated, the situations in which they’re levied, exceptions, and penalties for non-payment. Additional property tax regulations outside this law are virtually non-existent, as it encompasses nearly all tax regulations currently in effect.

Tax Payment Schedules

Each property tax described above *has a distinct payment schedule*, as detailed below.

1) Home Sales Tax

You must pay this tax within 10 days of signing the “Minute of Home Sale Contract” (a more formal home sale contract *that will be converted into a public deed of sale*).

This tax is paid to the local government of the Bolivian city where the house is located. Keep in mind that if you pay this tax but don’t complete the home purchase, *it will not be refunded*.

2) Annual Property Ownership Tax

You have almost the entire following year to pay this tax. Paying early offers several discounts, while late payments, such as those made at the end of the year, incur penalty fees. For example, if the property ownership tax corresponds to the 2022 cycle, you have nearly all of 2023 to pay it.

This tax can be paid at any Bolivian bank or through your online Bolivian bank account by presenting your foreigner ID card issued by the Bolivian government. It can also be paid by your legal representative in Bolivia, authorized to manage your property through a specific power of attorney (exercise caution with this option, as the representative could potentially defraud you!).

This tax offers significant discounts, up to 20% or 30%, for early payment, and penalty fees of a similar percentage for late payments.

3) Monthly Property Rental Tax

This tax must be paid monthly, during the month following the receipt of your rental income. In some cases, it may also be paid quarterly or annually, as this tax comprises several sub-taxes.

To pay the property rental tax, you’ll need to complete a form from Bolivia’s official public tax entity (SIN), available online for registered taxpayers. After completing the form, you’ll take the form number to a Bolivian bank for payment. You can also pay through your Bolivian online bank account or with the assistance of your legal representative in Bolivia.

Frequently Asked Questions About Property Taxes in Bolivia

Are Real Estate Taxes Different for Foreigners and Bolivians?

No, in all cases. Bolivian laws apply equally to Bolivians and foreigners, including tax laws. Therefore, you have the same rights and obligations as Bolivians when paying property taxes in our country.

The only difference will be the personal identification document you present to pay and process these taxes, which will be your *foreigner ID document issued by the Bolivian government*. Otherwise, you’ll follow the same procedures as Bolivians to pay these taxes, often using online tools.

This foreigner ID card is *issued only to temporary and permanent residents in Bolivia*. As you can imagine, it’s extremely difficult and risky to buy a house in our country as a tourist. We discuss this issue in detail in our guide on buying property here: Can foreigners buy property in Bolivia? All you need to know.

How Can I Determine and Pay My Outstanding Property Taxes in Bolivia?

You can determine your property ownership tax liability by following the steps outlined in our Spanish guide on this procedure (Translated: Link).

In summary, to determine at least how much you owe in property ownership tax, follow these steps:

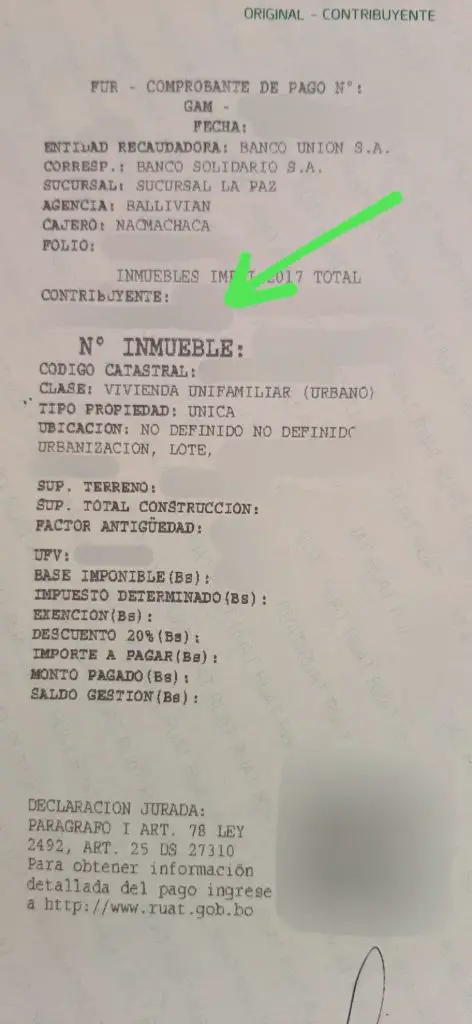

- Obtain the “proof of payment” for your property tax.

- Locate and record your property’s tax number from this proof of payment.

- Download the following application:

- Using your property’s tax number, follow the instructions in the app to determine your property ownership tax debt.

- You can also conveniently pay this tax at any bank in Bolivia.

Regarding the property sales tax in Bolivia, *it will always be 3% of the agreed-upon sale price of the house*. You’ll need to pay this to the local government of the city where the home is located.

Finally, regarding the property rental tax, it’s a more complex tax to determine and pay. You’ll first need a SIN account (the online platform of Bolivia’s official tax authority), which allows you to determine your exact rental tax liability. To obtain this account, you’ll need to complete some paperwork at the SIN institution. *You can only obtain this account by physically visiting a SIN office (there’s no online process) or through your Bolivian legal representative*.

How to Save Money When Paying Property Taxes in Bolivia?

If you’re paying the property ownership tax, *do so early in the year* to receive a discount of 20% to 30% on the tax amount.

The other two taxes, the property sales tax and the property rental tax, *do not offer any discounts*, and you’ll need to pay the full official tax amount.

Do not attempt to evade any of these taxes. They serve as proof of your property ownership in Bolivia in potential future legal disputes and lawsuits, and this proof can prevent you from losing your house. Furthermore, paying taxes is a legal obligation.

Conclusions

In this guide to property taxes in Bolivia, you’ve learned about the three primary taxes that will most affect you as a foreign homeowner: 1) the property sales tax, 2) the property ownership tax, and 3) the property rental tax.

You now know that the property sales tax is 3% of the total sale price and must be paid by the buyer. The property ownership tax ranges from 0.01% to 0.1% of the property’s market value and is paid annually. Finally, the property rental tax is approximately 16% of the rental income and is paid monthly.

You’ve also learned that these taxes are generally straightforward to pay, except for the property rental tax. The payment process is identical for Bolivians and foreigners, except that you’ll need to present your foreigner ID card. Additionally, you’ve discovered that discounts of up to 30% are available for early payment of the property ownership tax, but penalties apply for late payments.

Finally, you now know that you can pay these three property taxes through both physical and online methods, at any Bolivian bank, the local city government, or the official government tax entity (SIN), depending on the specific tax.

We hope this information has been helpful. If you’d like to learn about all the taxes applied and enforced in Bolivia, with detailed information on each, please visit our dedicated guide on the topic: Link.

CasasenBolivia.com, information on living, working, investing, and traveling in Bolivia.